- سلفادور الرائده في صناعه الكومباكت والكوريان

- 01004241714

- 01226177161

- info@salvador-eg.com

F.i.r.p.t.a Sale Of U.s. Property By Non-u.s. Resident Owner in Florence, South Carolina

Prostate Cancer and its Risk Factors

يونيو 10, 2023Obtain Better Natural Vision By Focusing on The Center

يونيو 10, 2023An additional guideline in the COURSE Act appears to provide, albeit in language that lacks quality (but is rather clarified in the related Joint Board on Tax), that a REIT distribution treated as a sale or exchange of supply under Sections 301(c)( 3 ), 302 or 331 of the Internal Revenue Code with regard to a professional investor is to make up a capital gain based on the FIRPTA keeping tax if attributable to a suitable investor and, however a normal returns if attributable to any type of other individual.

United States tax legislation calls for that all individuals, whether international or domestic, pay income tax on the personality of U.S. real residential or commercial property rate of interests. Domestic individuals or entities typically are subject to this tax as part of their normal income tax; however, the UNITED STATE required a method to gather taxes from foreign persons on the sale of U.S

Global Tax & Accounting Group – Miami, United States in Upland, California

Global Tax & Accounting Group – Miami, United States in Upland, CaliforniaFounded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia social Security and medicare tax refund for international students New Zealand.

The amount kept is not the tax itself, however is repayment therefore the tax obligations that inevitably will be due from the vendor. Unless an exemption or reduced price applies, FIRPTA requires that the buyer keep fifteen percent (15%) of the prices in all transactions in which the vendor of an U.S

The Foreign Investment In Real Property Tax Act (Firpta) – Cbre in Chesapeake, Virginia

The Substantial Existence Test: Under FIRPTA, a Foreign Person is taken into consideration an U.S. Person for the schedule year of sale if they exist in the United States for at the very least: I. 31 days throughout year of sale AND II. 183 days throughout the 3 year duration that includes year of sale as well as the 2 years preceding year of sale, yet just counting: a.

If the sole member is a “Foreign Individual,” then the FIRPTA withholding guidelines apply similarly as if the international sole participant was the seller. Multi-Member LLC: A domestic limited responsibility firm with greater than one owner is ruled out a “Neglected Entity” as well as is exhausted differently than single-member restricted liability companies.

Buying Real Property From A Foreign Seller Or Closing The … in Olympia, Washington

Accounting For Global Intangible Low-taxed Income – Fasb in Milford, Connecticut

Accounting For Global Intangible Low-taxed Income – Fasb in Milford, ConnecticutInternational Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

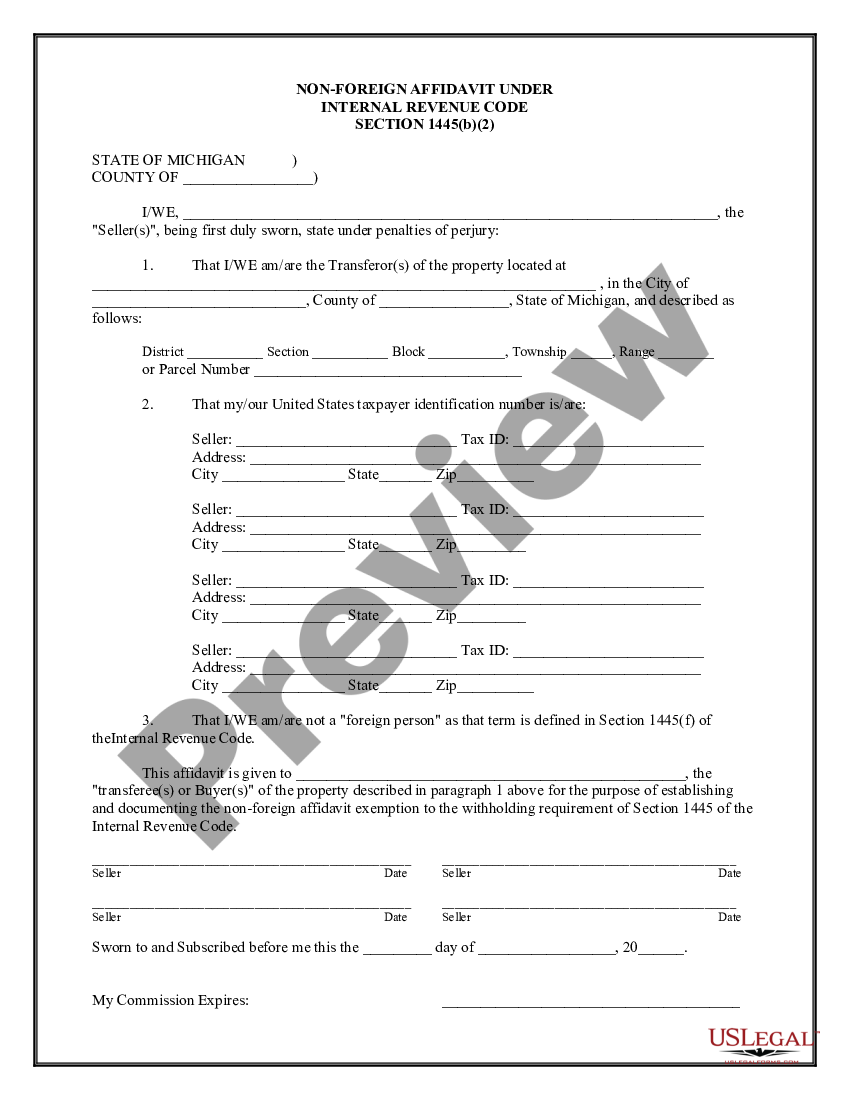

While there are numerous exemptions to FIRPTA withholding demands that remove or minimize the required withholding, one of the most common exemptions are gone over listed below. a – international tax consultant. Vendor not a “Foreign Individual.” One of one of the most usual as well as clear exemptions under FIRPTA is when the seller is not a Foreign Individual. In this instance, the seller needs to provide the customer with an affidavit that certifies the seller is not an International Individual and also supplies the seller’s name, UNITED STATEUnder this exemption, the customer is not called for to make this political election, even if the facts may support the exemption or minimized rate as well as the settlement representative ought to advise the customer that, neither, the exemption neither the minimized rate immediately uses. Rather, if the customer decides to invoke the exception or the decreased price, the customer should make an affirmative election to do so.