- سلفادور الرائده في صناعه الكومباكت والكوريان

- 01004241714

- 01226177161

- info@salvador-eg.com

New Path Act Modifies Tax Rules Applicable To – O’melveny in Rialto, California

Hire Toronto Real Estate Agent to Help You Find Your Dream Home

يونيو 12, 2023High 10 $255 Payday Loans Online Same Day Accounts To Comply with On Twitter

يونيو 12, 2023

Another guideline in the PATH Act shows up to supply, albeit in language that does not have clarity (however is somewhat clarified in the associated Joint Board on Tax), that a REIT circulation treated as a sale or exchange of stock under Sections 301(c)( 3 ), 302 or 331 of the Internal Earnings Code with respect to a competent shareholder is to comprise a capital gain based on the FIRPTA withholding tax if attributable to a suitable capitalist as well as, however a regular reward if attributable to any type of other individual.

United States tax law requires that all individuals, whether international or residential, pay earnings tax on the disposition of UNITED STATE genuine building rate of interests. Domestic persons or entities typically are subject to this tax as part of their routine earnings tax; nevertheless, the UNITED STATE required a method to accumulate tax obligations from international individuals on the sale of UNITED STATE

Founded in 2015 and iwtas.com located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

The amount withheld is not the tax itself, however is repayment therefore the tax obligations that eventually will be due from the vendor. Unless an exemption or lowered price uses, FIRPTA requires that the customer withhold fifteen percent (15%) of the list prices in all purchases in which the seller of an U.S

Real Est Fin Jrnl V31 #2 Pam – Mayer Brown in Texarkana, Texas

The Considerable Existence Test: Under FIRPTA, a Foreign Person is thought about a UNITED STATE Individual for the fiscal year of sale if they exist in the United States for a minimum of: I. 31 days during year of sale AND ALSO II. 183 days during the 3 year period that includes year of sale and the 2 years coming before year of sale, but only counting: a.

If the sole participant is a “Foreign Person,” after that the FIRPTA withholding regulations use in the same manner as if the international single participant was the vendor. Multi-Member LLC: A residential limited liability business with more than one proprietor is ruled out a “Disregarded Entity” and is exhausted differently than single-member minimal obligation firms.

Canada: Canadians Looking To Sell Us Real Estate – Mondaq in Hendersonville, Tennessee

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

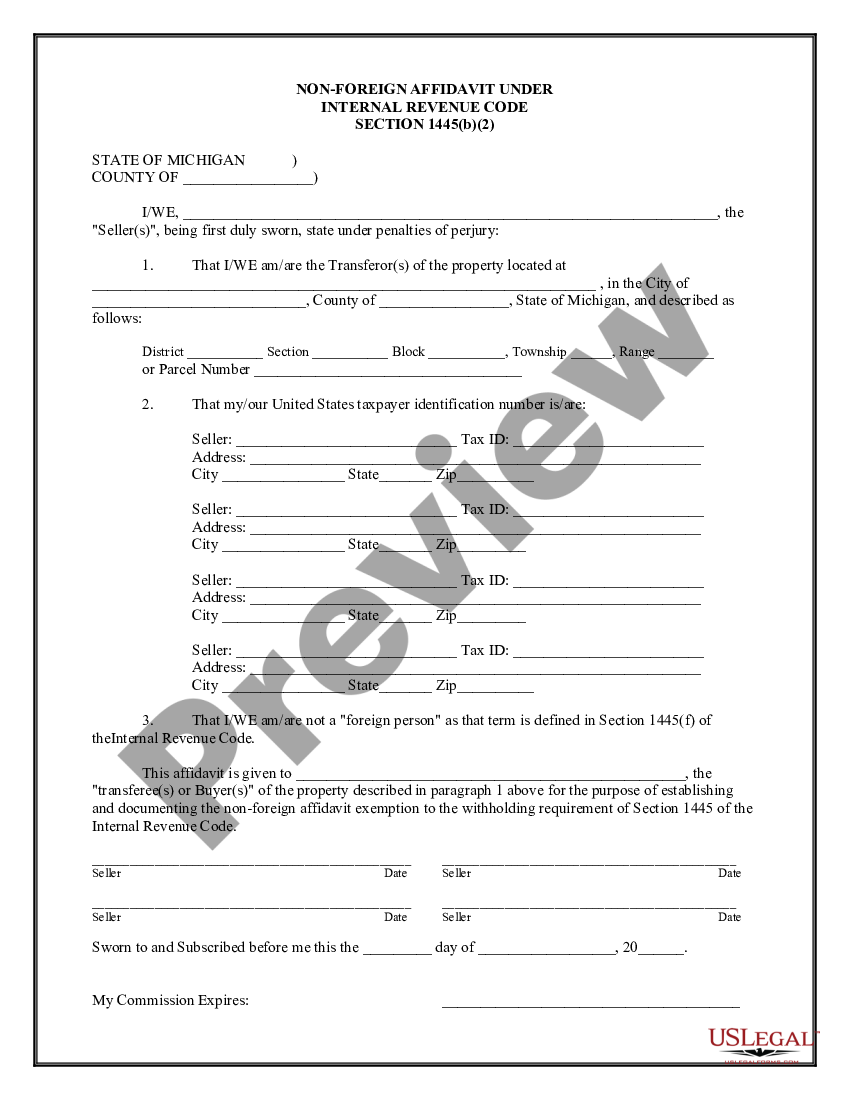

While there are a number of exceptions to FIRPTA withholding needs that eliminate or lower the needed withholding, the most usual exceptions are reviewed listed below. a – international tax consultant. Seller not a “International Person.” One of the most usual and clear exemptions under FIRPTA is when the vendor is not a Foreign Individual. In this situation, the seller should give the purchaser with a testimony that licenses the seller is not an International Individual as well as gives the seller’s name, UNITED STATEUnder this exemption, the customer is not needed to make this election, even if the realities may sustain the exception or reduced rate and also the negotiation representative must suggest the buyer that, neither, the exemption nor the decreased price immediately applies. Instead, if the buyer opts to invoke the exemption or the decreased rate, the customer should make an affirmative election to do so.