- سلفادور الرائده في صناعه الكومباكت والكوريان

- 01004241714

- 01226177161

- info@salvador-eg.com

Fasb And Iasb Issue Revenue Recognition Standard in Homestead, Florida

Guy Sebastian’s long-timer manager has been jailed for a minimum two-and-a-half years for embezzling more than $600,000 from his star client

يونيو 10, 2023Incomes a Six Figure Revenue From Free Matched Betting

يونيو 10, 2023personal companies and also organizations are called for to use the revenue standard for yearly reporting periods starting after Dec. 15, 2017, as well as acting as well as annual reporting after that. While the effective date for the brand-new requirement might appear far, you now need to begin reviewing the effect of the requirement on their service.

Depending upon your market, changes can vary from minimal to considerable. Obtaining the systems and also procedures in position prior to the requirement is applied will certainly aid improve your shift. This material is accurate as of the date published over and undergoes transform. Please look for professional advice prior to acting on any kind of matter contained in this short article.

The International Accountancy Standards Board (IASB) after that adhered to match and released similar assistance as a part of the International Financial Reporting Criteria (IFRS) to dictate when that profits can be taken into consideration made and also the economic statement precisely upgraded. Curious when your company should recognize its income? Check out on for the most recent and also best in our extensive profits acknowledgment overview.

Normally, earnings is identified after the efficiency obligations are considered fulfilled, and also the dollar amount is easily quantifiable to the business. An efficiency responsibility is the pledge to give a “distinct” excellent or solution to a customer. On the surface area, it may seem simple, but a performance commitment being considered fulfilled can vary based on a variety of aspects.

Gasb Home in Overland Park, Kansas

, the profits recognition concept is not appropriate. Essentially, the earnings acknowledgment concept implies that firms’ revenues are recognized when the service or item is thought about supplied to the client not when the cash is gotten.

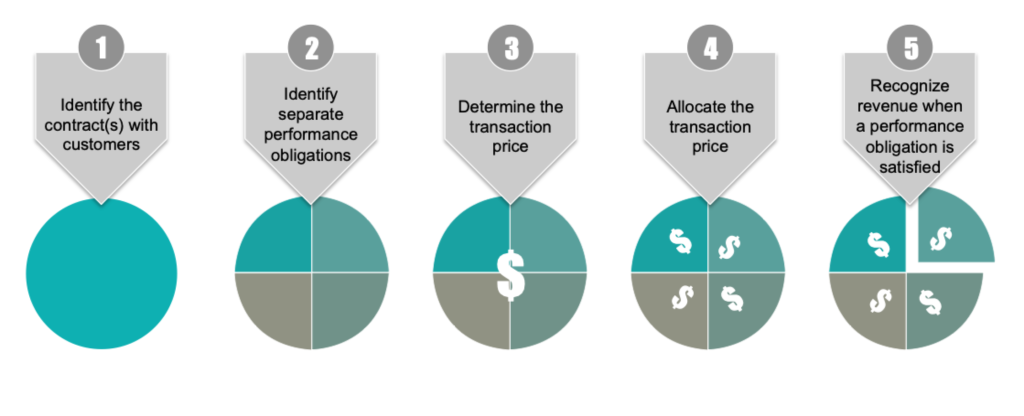

In order to precisely acknowledge earnings, firms should take note of the 5 steps and also guarantee they are translating them properly – capital gains tax non resident alien. ASC 606 has actually outlined the Five-Step Version much more on this later. Why Is Revenue Acknowledgment Important? Correct income recognition is necessary since it associates directly to the stability of a business’s economic reporting.

This standardization allows external entities like analysts and also capitalists to quickly contrast the revenue declarations of different firms in the same market. Because income is just one of the most vital procedures made use of by capitalists to assess a business’s efficiency, it is crucial that financial statements be regular and reputable. Profits Acknowledgment Instances To better recognize revenue acknowledgment, allow’s go through 2 instances of firms with different company models (capital gains tax non resident alien).

It additionally charges a single $50 start-up fee for the procedure of discovering more regarding the customer, producing a curated option of coffees and also sending a pour-over coffee maker as a component of the membership program. As soon as the initial procedure is total (i. e., the customer has completed the survey, the business has developed a curated strategy and also the pour-over coffee machine has been delivered), that $50 can be acknowledged.

Technical Line: The New Revenue Recognition Standard in Texas City, Texas

are called for to comply with GAAP requirements. While personal companies are not technically called for to abide by GAAP, they may discover it essential for funding and expansion possibilities. For some global companies, IFRS enters play in contrast to GAAP. Several firms willingly adhere to IFRS guidelines, yet in some 144 nations that have mandated IFRS, these audit practices are a lawful requirement for banks as well as public business.

Vendor has no control over items offered. The collection of settlement from items or services is reasonably assured. Amount of profits can be reasonably measured. Expense of income can be sensibly measured. These requirements drop under three buckets that IFRS list as needed for an agreement to exist: performance, collectability and measurability.

The 3rd is a “collectability” problem, which implies that the seller should have an affordable expectation of being paid. The last two are considered “measurability” conditions as a result of the matching concept: the vendor has to be able to match expenditures to the profits it helped earn. The quantity of incomes and also costs ought to both be sensibly measurable.

U.S.-based public firms should stick to GAAP’s revenue acknowledgment standards. Whether personal firms are needed to follow them is a lot more complicated. From a strictly lawful viewpoint, personal firms are not required to follow GAAP criteria in the U.S. However, from a much more de facto perspective, companies may require to adhere to earnings acknowledgment requirements for numerous reasons.

What You Need To Know About Revenue Recognition – Fasb in Flower Mound, Texas

This suggests that both sides anticipate the future cash flows of a business will change as a result of the deal. This indicates that settlement is most likely to be obtained (i. e., the consumer’s debt risk ought to be assessed at contract beginning).

A performance obligation is a guarantee in a contract to move a great or service to the consumer. There are 2 criteria for a good or service to be thought about unique, as well as both of those standards need to be satisfied. An excellent or service can standing out if the customer can benefit from it by itself or with various other sources that are easily available.

In many situations, this action is uncomplicated, as the seller will get a set quantity of cash all at once with the transferred items or solutions. Effects from numerous factors can make complex the determination: Variable considerations: When there is uncertainty around the quantity of factor to consider, like in instances of price cuts, refunds, refunds, credit ratings, rewards and also similar products.

The presence of a significant funding part: When there is more than a year in between getting consideration and moving goods or solutions, a contract may have a substantial financing part. A financing component in the transaction rate takes into consideration the moment worth of money. Non-cash factors to consider: When a consumer pays in the type of goods, services, stock or various other non-cash consideration.

Gasb Home in South Gate, California

If a contract has even more than one performance responsibility, a company will need to allot the transaction rate per separate performance obligation based on its relative standalone asking price. The last action is to identify earnings when or as the efficiency obligations in the agreement are pleased. Transfer of Control: When a client acquires control over the possession, it is taken into consideration transferred and also the company’s efficiency responsibility is considered completely satisfied.

Performance Obligations Satisfied In Time: As a business transfers control of an excellent or service over time, it pleases the performance commitment and can identify income gradually if among the adhering to standards is met: The client gets and also consumes the advantages provided by the entity’s performance as the entity executes.

The entity’s performance does not create an asset with an alternate use to the entity (see FASB ASC 606-10-25-28), and also the entity has an enforceable right to payment for efficiency completed to date – capital gains tax non resident alien. An example of performance responsibilities being pleased in time would certainly be a routine or recurring cleaning service.

Performance Commitments Satisfied at a Moment: If an efficiency obligation is not pleased over time, the efficiency obligation is satisfied at a moment. To figure out the moment at which a client obtains control of a guaranteed property and the business pleases an efficiency responsibility, it needs to think about support on control as well as the following signs of the transfer of control: The business has an existing right to payment for the property.

Contributions Received And Contributions Made – Applying A … in Lake Havasu City, Arizona

Gauging Development Towards Complete Fulfillment of a Performance Responsibility: For Every performance commitment pleased in time, a business needs to acknowledge revenue over time by determining the progression toward full satisfaction of that efficiency responsibility. Techniques for gauging progress include the following: Result Approach: Results are goods or solutions ended up as well as moved to the client.

The entity then tracks the progression toward conclusion of the contract by determining outputs to date relative to overall approximated results required to satisfy the efficiency responsibility. Number of items generated or solutions delivered are both instances of output procedures. Input Approach: Inputs are determined by the quantity of effort that has actually been placed right into pleasing an agreement.

For those entities, they might elect to embrace the criterion for yearly coverage periods starting after December 15, 2019 as well as acting reporting periods within annual reporting periods beginning after December 15, 2020. The IASB made its standards provided in IFRS 15 effective economic declarations issued on or after 1 January 2018.

Therefore, progressed economic administration software will certainly aid you timetable, compute and existing income on your monetary statements accurately, automating revenue forecasting, appropriation, recognition, reclassification, and also bookkeeping through a rule-based event taking care of framework whether your business carries out sales deals that are composed of items or services, or both, as well as, whether these transactions occur at a single time or across various milestones – capital gains tax non resident alien.

Fasb And Iasb Issue Revenue Recognition Standard in Elkhart, Indiana

Despite the fact that many smaller companies are exclusive and for that reason not called for to follow GAAP, several still adhere to the standard. From a funding point of view, GAAP economic declarations are frequently understood by lending institutions as well as financiers, providing reliability to the economic coverage as well as the company as a whole. Thus, having GAAP-compliant income recognition techniques as well as financial declarations can open up even more funding options and also resources, commonly at a lower cost making it much easier to develop and also expand a service.

Normally Accepted Bookkeeping Principles (U.S. GAAP) and also International Financial Reporting Specifications (IFRS) still deviate enough to materially impact the monetary statements. Firms that have entities that report locally in UNITED STATE GAAP as well as IFRS should be mindful of these distinctions and the impact to their consolidated financials. Both ASC 606 as well as IFRS 15, “Profits from Contracts with Customers,” run off of the core principle that an entity is to identify earnings that represents the transfer of a guaranteed excellent or service to an additional celebration at a quantity that the entity deems suitable for the exchange.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Iwtas.com Switzerland, Australia and New Zealand.

Recognize the earnings at the contentment of each performance responsibility. The fostering of these actions has merged lots of aspects of GAAP as well as IFRS, there are some differences that divide the 2 revenue acknowledgment criteria.

entities. Another policy election under U.S. GAAP is the discussion of sales tax and other comparable tax obligations. ASC 606 allows companies to choose to omit sales tax and also particular other tax obligations from the dimension of the purchase cost in action three above. If a company reporting under U.S. GAAP chooses to make this political election, the company then has to consider the truth that IFRS does not permit for the exact same election.

Revenue From Contracts With Customers – 2019 Global Edition in Hot Springs, Arkansas

One crucial point to note is that IFRS 15 allows an useful option for companies to choose either the complete or changed retrospective strategy for transforming to the brand-new revenue recognition standard. The complete approach reiterates financials as if IFRS 15 has constantly been applied; whereas the customized method reports a cumulative modification at the time of conversion.

In order for an income contract to be identifiable, both the FASB and IASB approved a collectability threshold that must be satisfied. This limit needs that entities must identify if the collectability of revenue is “likely” prior to identifying it. However, IFRS and also GAAP both provide different definitions for the term “likely” in this context.

IFRS defines “possible” as if the future occasions are more probable than not to happen. This subtle distinction stays because changes in this interpretation would affect more than one criterion for both GAAP as well as IFRS. The reversal of disability losses has likewise been a location for distinctions in IFRS and UNITED STATE

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

There are likewise some other much less typical distinctions in between the 2 profits recognition criteria that are past the scope of this short article. IFRS 15 was reliable January 1, 2018 and ASC 606 has staggered reliable days for UNITED STATE public and nonpublic companies. For more details concerning profits recognition under IFRS and also UNITED STATEHistorically, there has actually been diversity in method surrounding just how to use the principal versus representative concept. The new revenue acknowledgment guidelines have actually cleared up as well as boosted advice surrounding the application. Exactly How Representative vs Principal Can Impact the Acknowledgment of Your Business’s Revenue If a 3rd party is involved in offering goods or services to your customer, your business needs to assess whether it is serving as a principal or a representative.